Ножовки – незаменимый инструмент для работы с деревом, металлом и другими материалами. Среди множества

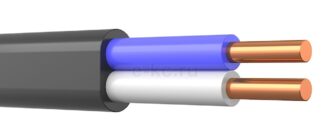

У світі кабелів ВВГ посідає особливе місце. Не просто набір букв, а символ цілої

Ремонт побутової техніки — справа відповідальна і потребує професійного підходу. Адже від якісного ремонту

В современном сельском хозяйстве эффективное хранение сельскохозяйственной продукции является одним из ключевых факторов успеха.

Плиткорезами называются устройства для резки кафельной плитки, а также гранита, керамогранита и прочих облицовочных

Довідка про несудимість є документом, що підтверджує відсутність судимості у громадянина. Цей документ може

Дизайн-проект интерьера в Одессе — это детальная разработка и планировка внутреннего пространства жилого или

Выбор дивана — важный этап при обустройстве дома или офиса. Из этого предмета мебели

Прямокутні профільні труби є важливим будівельним та інженерним матеріалом, який знаходить широке застосування у

Как купить диплом училища в Казахстане? Училище относится к учреждениям среднего специального образования. Оно